by Doug Kartsen, CFA

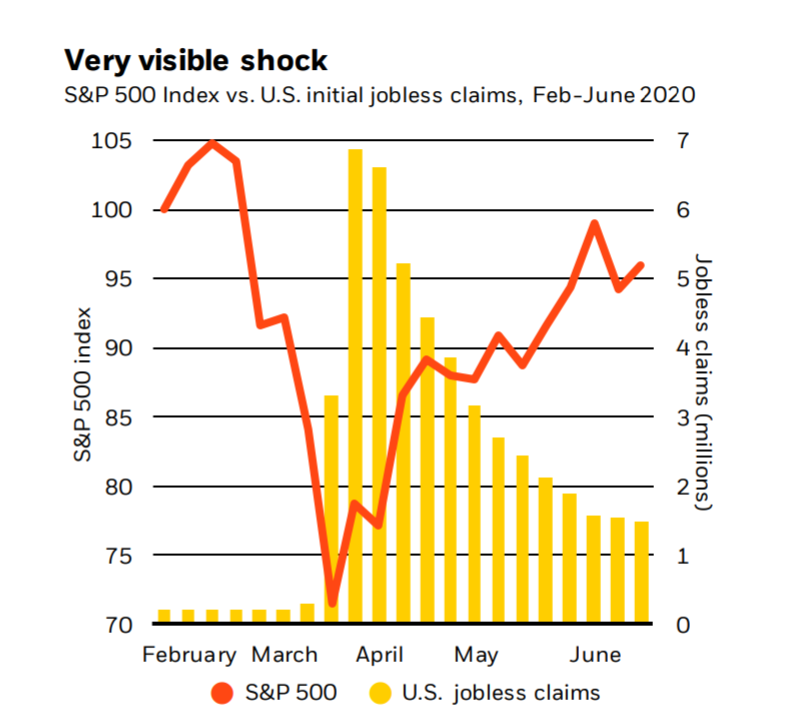

After a tumultuous 33 days where the S&P 500 dropped approximately 34%, stocks snapped back quickly on optimism of business reopening and the enormous and rapid stimulus offered by the federal government and Central Bank. This most recent quarter was the 9th strongest in the history of the S&P 500, despite historic unemployment and the lack of a cure for Covid-19. But the market is forward looking and the expectations for a vaccine and a strong earnings recovery across most sectors is high.

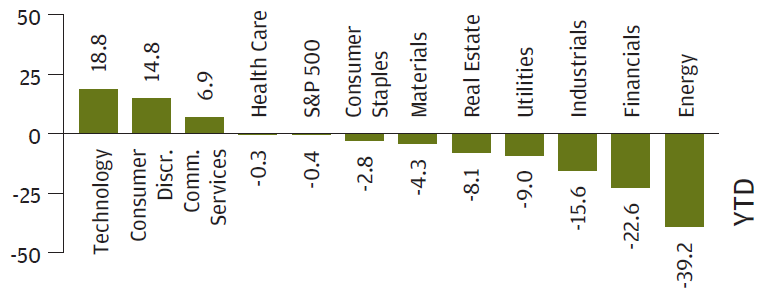

Now, having climbed back from recent lows, performance of the S&P 500 is close to flat for the year. This recovery masks the bifurcation of the market. Growth stocks, technologically focused in particular, have led the recovery. Many of these companies have strong earnings and balance sheets, and their business models reflect structural changes in the economy. However, risks for industrials and traditional energy stocks remain. Likewise, financials, particularly banks, are held back due to low interest rates and the potential for defaults to exceed expectations. While we can only speculate how quickly we will get past the Covid-19 crisis, it is worth noting that when sectors have reached all-time lows in S&P weightings, as industrials, energy and financials have done, they tend to strongly outperform over the next three years. Therefore it remains important to stay-the-course and be diversified

Early in the third quarter, valuations appear stretched by some measures. This is not uncommon in a recovery, and while there are many reasons for optimism it is prudent to remain cautious. This includes holding higher quality securities and using hedging strategies where appropriate. I expect the market to be volatile and range-bound while we wait for: (1) details on a second round of stimulus, (2) clarity on how and whether schools reopen, (3) the results of the 2020 election, (4) a tax plan for paying down skyrocketing government debt, and (5) a proven vaccine for Covid-19. Several vaccines have been fast tracked, but none are likely to be ready before year-end.

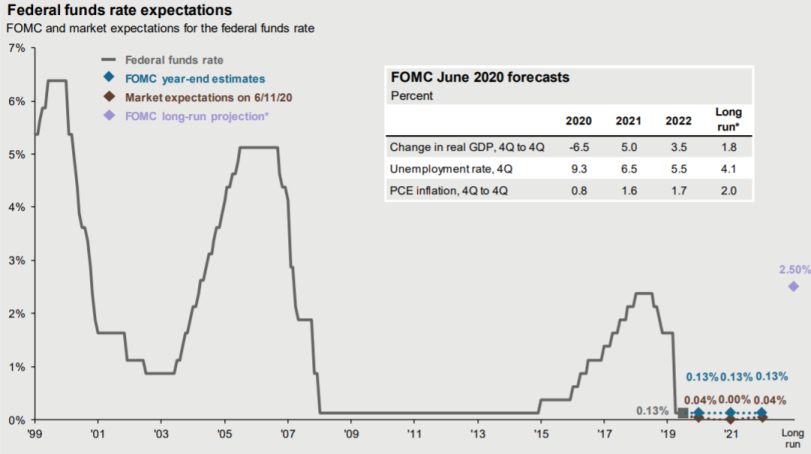

As portfolios typically comprise both stocks and bonds, it is important to address the low interest rate on bonds (about 0.65% on 10-year Treasuries) and the expectation of lower rates for longer. Alas, should the virus get ahead of us or taxes explode, I do not expect bonds to provide the same ballast that they have in the past. Still, they remain an important component to a well-diversified portfolio. And with inflation seemingly nowhere to be found, it may be beneficial to start adding TIPS to portfolios.

Lastly, I believe that disruptions in the supply lines made evident by trade disputes with China and Covid-19 will change how companies do business. This could have the desired, though unintended, effect of reducing correlations between US and international stock markets. In a world where bonds may offer less diversification benefits, international markets could again be an added solution.